Here's a link to a great article on

The Silver Bear Cafe

If you really want to know WHY you MUST have GOLD & SILVER, here is a couple paragraphs from the article.

This is a very fundamental question. I think one of the best answers came from a movie called the Treasure of Sierra Madre. An old miner was explaining why gold has value. He said that 1,000 men head for the hills with pick axes and provisions after 6 months only one finds any gold. That find represents not only the labor of the man that finds that gold but that of the other 999 miners that did not find anything. That is 6,000 months or 500 years scrambling over mountains going hungry and thirsty. Think about the luck of finding something so rare. Think about how much energy, labor, ingenuity and time that goes into finding silver or gold. Sometimes it takes moving a couple tons of earth to find one ounce of gold or silver. And here we can buy all of that for less than a dinner for four at your local sports bar.

*********************************

When Silver peaked in 1980 you could buy the average house for about 800 ounces of silver. This was the days of 20% mortgages and the inflation "slayer" Paul Volker. If you got out of housing at the top of the recent housing bubble you could have traded out of your inflated house value and into the undervalued silver and took delivery of say 40,000 ounces of silver. If/when we get back to the silver house ratio of 1980 you will be able to buy 50 houses for your 40,000 ounces.

**********************************

The average price of a home in Canada in 2010 was $331,000 and an ounce of silver was $50 at its peak back in 1980. If we apply the above scenario ($331,000 per home / 800oz of silver), the price of silver today should be $413.75/oz! , yet silver is trading for about $33/oz? I think it's safe to say that silver is WAY UNDERVALUED and due for a HUGE gain in the years ahead! BK

Saturday, February 26, 2011

Canadian Mint Sold ALL its Silver?

From: http://www.zerohedge.com/

Clark: Many people don't realize this, but silver rose 3,646% in the 1970s, from its November '71 low to its January 1980 high. If you were to apply the same percentage rise to our current bull market, silver would climb another 500% from here, and the price would hit $160 an ounce.

Clark: Many people don't realize this, but silver rose 3,646% in the 1970s, from its November '71 low to its January 1980 high. If you were to apply the same percentage rise to our current bull market, silver would climb another 500% from here, and the price would hit $160 an ounce.

Tuesday, February 22, 2011

Groenewegen Says High Rates May Dull Gold, Silver Demand

You’re watching Groenewegen Says High Rates May Dull Gold, Silver Demand. See the Web's top videos on AOL Video

**********************************************

Groenewegen says Silver at $45-50, sounds good to me! Keep in mind folks, one of the main reasons to invest and put your hard earned money at risk is to maintain a good standard of living, or at least it should be. Pay attention to what Groenewegen says about food prices, he is on the money. As we have pointed out before, "cost of living" and real inflation is what people should watch out for. Focus on traditional foods, maybe even start a garden? BK

Why "Dr. Copper" is the Master Metal

Peter Koven, Financial Post · Friday, Feb. 18, 2011

Since bottoming out in early 2009, the price of copper has nearly quadrupled, driven by strong demand from emerging markets, shrinking inventories and lack of new supply. The metal, which traded around US70¢ a pound through the 1990s, is now worth about US$4.50 and hit a new record earlier this week. When priced in tonnes, it recently passed the landmark level of US$10,000. LINK...

*********************************************

Not only is copper breaking all-time-highs, but most other base metals AND precious metals are also, EXCEPT SILVER!

"BUY LOW -- SELL HIGH," is the plan. The confusing part is, how to determine if an investment is at it's HIGH or LOW? The fact that Silver is far below its previous highs in 1980 ($50/oz) is a clear indication that Silver is still largely undervalued, and we have much much higher to go before we see any type of a top formation in Silver. BK

Since bottoming out in early 2009, the price of copper has nearly quadrupled, driven by strong demand from emerging markets, shrinking inventories and lack of new supply. The metal, which traded around US70¢ a pound through the 1990s, is now worth about US$4.50 and hit a new record earlier this week. When priced in tonnes, it recently passed the landmark level of US$10,000. LINK...

*********************************************

Not only is copper breaking all-time-highs, but most other base metals AND precious metals are also, EXCEPT SILVER!

"BUY LOW -- SELL HIGH," is the plan. The confusing part is, how to determine if an investment is at it's HIGH or LOW? The fact that Silver is far below its previous highs in 1980 ($50/oz) is a clear indication that Silver is still largely undervalued, and we have much much higher to go before we see any type of a top formation in Silver. BK

Saturday, February 19, 2011

The Silver Super Bull is Coming...

Sales Silver Maple Leaf Coins Surged in 2010, Canadian Mint Says

By Pham-Duy Nguyen - Feb 17, 2011 7:00 PM ET

About 10.3 million ounces were sold in 2009, and the mint is “on pace” to surpass that level for 2010, Alex Reeves, the agency’s communications manager, said yesterday. Last year’s sales data will be released in late March, Reeves said.

“Demand has exceeded supply, and we are trying to be fair to all our customers by putting caps on the size of the orders,” Reeves said. “We are not going to sell all of our silver to one distributor.” Reeves declined to comment on the specifics of the caps. LINK...

*********************************************

Silver is practically the only "commodity", never mind metal, that is not breaking long-term highs. In 1980 silver hit $50/oz, while gold hit $850/oz. Today gold is 63% above its 1980 high, so if we apply that number to silver, maybe silver should be about $80/oz RIGHT NOW? BK

See our post: "Silver Gets No Respect"

By Pham-Duy Nguyen - Feb 17, 2011 7:00 PM ET

About 10.3 million ounces were sold in 2009, and the mint is “on pace” to surpass that level for 2010, Alex Reeves, the agency’s communications manager, said yesterday. Last year’s sales data will be released in late March, Reeves said.

“Demand has exceeded supply, and we are trying to be fair to all our customers by putting caps on the size of the orders,” Reeves said. “We are not going to sell all of our silver to one distributor.” Reeves declined to comment on the specifics of the caps. LINK...

*********************************************

Silver is practically the only "commodity", never mind metal, that is not breaking long-term highs. In 1980 silver hit $50/oz, while gold hit $850/oz. Today gold is 63% above its 1980 high, so if we apply that number to silver, maybe silver should be about $80/oz RIGHT NOW? BK

See our post: "Silver Gets No Respect"

Wednesday, February 16, 2011

Your Reliable Source for SILVER

The Silver Super Bull is coming soon and we're prepared with HUNDREDS of THOUSANDS of ounces available at our warehouses across Canada and the U.S.A.

Please call for the latest quote.

Please call for the latest quote.

Inflation in Wonderland is 2%

As seen in The International Forecaster.

Percentage of Price Increase in just the last 6 months:

Source: www.indexmundi.com/

- Sugar +81%

- Rice +12%

- Wheat +67%

- Soybeans +37%

- Coffee +28%

- Barley +25%

- Beef +28%

- Chicken -3%

- Salmon +7%

- Crude Oil +24%

- Natural Gas - 2%

- Coal +38%

- Cotton +131%

- Coarse Wool +30%

- Fine Wool +69%

- Gold +13%

- Silver +59%

- Copper +41%

- Aluminum +22%

- Zinc +29%

- Nickel +31%

- Lead +41%

************************************************

They say these prices take 6-12 months to work themselves into the real economy. Maybe it's time to adjust our retirement plans? BK

Percentage of Price Increase in just the last 6 months:

Source: www.indexmundi.com/

- Sugar +81%

- Rice +12%

- Wheat +67%

- Soybeans +37%

- Coffee +28%

- Barley +25%

- Beef +28%

- Chicken -3%

- Salmon +7%

- Crude Oil +24%

- Natural Gas - 2%

- Coal +38%

- Cotton +131%

- Coarse Wool +30%

- Fine Wool +69%

- Gold +13%

- Silver +59%

- Copper +41%

- Aluminum +22%

- Zinc +29%

- Nickel +31%

- Lead +41%

************************************************

They say these prices take 6-12 months to work themselves into the real economy. Maybe it's time to adjust our retirement plans? BK

Sunday, February 13, 2011

Silver in Backwardation and the Emperor, Nearly Naked

Jesse's Cafe Americain

US silver term structure inverts as supply tightens

By Frank Tang

February 11, 2011

NEW YORK, Feb 11 (Reuters) - The tightest physical silver supplies in four years have tipped the U.S. silver futures market into backwardation this week, making near-term prices more expensive than more distant months.

Market watchers said that it has been more than 10 years since silver futures were last in backwardation, an unusual term structure, associated with shortage of physical supply. Warehouse stocks of the white metal have dropped to a four-year low on surging demand, while miners have hedged their future production. LINK...

**********************************************

We have HUNDREDS of 100oz Silver Bars available, Royal Canadian Mint or Johnson Matthey.

International clients who do NOT have Silver Bars in their country of residence, please ask about our special U-Vault Account for storage at Brinks Canada. BK

US silver term structure inverts as supply tightens

By Frank Tang

February 11, 2011

NEW YORK, Feb 11 (Reuters) - The tightest physical silver supplies in four years have tipped the U.S. silver futures market into backwardation this week, making near-term prices more expensive than more distant months.

Market watchers said that it has been more than 10 years since silver futures were last in backwardation, an unusual term structure, associated with shortage of physical supply. Warehouse stocks of the white metal have dropped to a four-year low on surging demand, while miners have hedged their future production. LINK...

**********************************************

We have HUNDREDS of 100oz Silver Bars available, Royal Canadian Mint or Johnson Matthey.

International clients who do NOT have Silver Bars in their country of residence, please ask about our special U-Vault Account for storage at Brinks Canada. BK

Thursday, February 10, 2011

Canada's Housing Market Not So Good After All?

Janet Whitman, Financial Post · Tuesday, Feb. 8, 2011

Canada is "a purely random success story": Shiller

NEW YORK — Canada is being feted in international circles after coming through the financial crisis relatively unscathed, but the accolades may be unwarranted.

That’s the conclusion of a leading U.S. economist who’s crunched the numbers and determined two factors that may take Canada down a notch or two: the housing market looks due for a U.S.-style drop; and, without oil, the country would be in trouble.

Robert Shiller, the Yale professor who correctly predicted the 1987 stock market collapse and the recent U.S. housing market meltdown, said Canada’s robust financial health compared to other nations is largely due to a random run-up in oil prices in the midst of the global financial crisis. LINK...

Canada is "a purely random success story": Shiller

NEW YORK — Canada is being feted in international circles after coming through the financial crisis relatively unscathed, but the accolades may be unwarranted.

That’s the conclusion of a leading U.S. economist who’s crunched the numbers and determined two factors that may take Canada down a notch or two: the housing market looks due for a U.S.-style drop; and, without oil, the country would be in trouble.

Robert Shiller, the Yale professor who correctly predicted the 1987 stock market collapse and the recent U.S. housing market meltdown, said Canada’s robust financial health compared to other nations is largely due to a random run-up in oil prices in the midst of the global financial crisis. LINK...

The Most Dangerous and Risky Investment

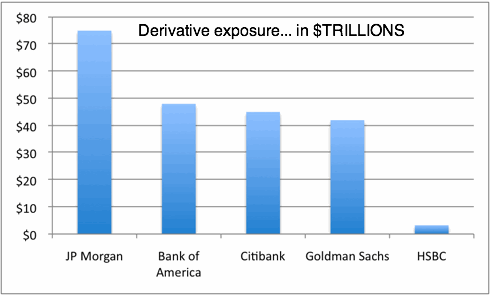

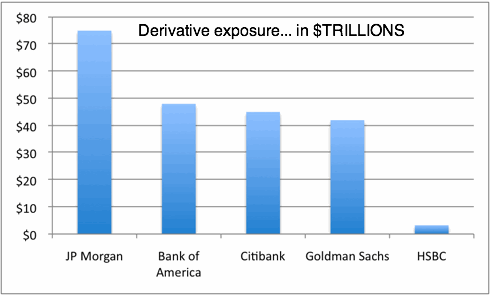

Derivatives: The Real Reason Bernanke Funnels Trillions Into Wall Street Banks

From: http://www.seekingalpha.com/

Of course, Bernanke tells the public and Congress that the reason we need low interest rates is to support housing prices. He doesn’t mention that $188 TRILLION of the $223 TRILLION in notional value of derivatives sitting on the Big Banks’ balance sheets is related to interest rates.

Yes, $188 TRILLION. That’s thirteen times the US’ entire GDP, and nearly four times WORLD GDP.

Now, of course, not ALL of this money is “at risk,” since the same derivatives can be traded/spread out dozens of ways by different banks as a means of dispersing risk.

However, given the amount of money at stake, if even 4% of this money is “at risk” and 10% of that 4% goes wrong, you’ve wiped out ALL of the equity at the top five banks. LINK...

*******************************************************************

Dear readers,

This article brings back memories of my days as a derivatives broker in the U.S.A., and part of the reason why my eyes were opened to the REAL financial system and GOLD. I can tell you from experience that 90% of the people who trade derivatives LOSE! The reason for this is extreme leverage and time. Derivatives are a leveraged financial contract that performs based on the value of the physical product it represents. It's similar to a mortgage on a house, you put 5% down to control an asset worth $100,000. If that asset goes down 5% you lose all your money. The big difference is you can't hold the contract for 25 years to pay off the balance. You sometimes have 25 DAYS or less to make a profit, otherwise you lose and have to pay the full balance of the contract at expiration. I had some clients who would only hold positions for 2-3 hours, never mind days or weeks. This is only a basic explanation and I don't want to bore you with all the details, but understanding the shear magnitude of the contracts these banks are holding is cause for serious alarm. BK

From: http://www.seekingalpha.com/

Of course, Bernanke tells the public and Congress that the reason we need low interest rates is to support housing prices. He doesn’t mention that $188 TRILLION of the $223 TRILLION in notional value of derivatives sitting on the Big Banks’ balance sheets is related to interest rates.

Yes, $188 TRILLION. That’s thirteen times the US’ entire GDP, and nearly four times WORLD GDP.

Now, of course, not ALL of this money is “at risk,” since the same derivatives can be traded/spread out dozens of ways by different banks as a means of dispersing risk.

However, given the amount of money at stake, if even 4% of this money is “at risk” and 10% of that 4% goes wrong, you’ve wiped out ALL of the equity at the top five banks. LINK...

*******************************************************************

Dear readers,

This article brings back memories of my days as a derivatives broker in the U.S.A., and part of the reason why my eyes were opened to the REAL financial system and GOLD. I can tell you from experience that 90% of the people who trade derivatives LOSE! The reason for this is extreme leverage and time. Derivatives are a leveraged financial contract that performs based on the value of the physical product it represents. It's similar to a mortgage on a house, you put 5% down to control an asset worth $100,000. If that asset goes down 5% you lose all your money. The big difference is you can't hold the contract for 25 years to pay off the balance. You sometimes have 25 DAYS or less to make a profit, otherwise you lose and have to pay the full balance of the contract at expiration. I had some clients who would only hold positions for 2-3 hours, never mind days or weeks. This is only a basic explanation and I don't want to bore you with all the details, but understanding the shear magnitude of the contracts these banks are holding is cause for serious alarm. BK

Wednesday, February 9, 2011

J.P. Morgan Will Accept Gold as Collateral

by Carolyn Cui and Rhiannon Hoyle

Tuesday, February 8, 2011

Wall Street Journal

By making the announcement, J.P. Morgan is effectively saying gold is as rock solid an investment as triple-A rated Treasurys, adding to a movement that places gold at the top tier of asset classes. It also is trying to capitalize on all the gold now owned by hedge funds and private investors that is sitting idle in warehouses. LINK...

**************************************

Think about what this really means folks? J.P. Morgan one of the most powerful Wall Street Bankers is saying they want your Gold Bullion in exchange for their securities? One has to ask themselves, WHY NOW?

J.P. Morgan is willing to accept a volatile, risky and "Barbarous Relic" as collateral for securities that are as good as AAA rated U.S. Treasury's? Could this mean that the U.S.A. is about to lose their AAA status OR is Gold about to go SKY HIGH? As we said in previous posts,

"He who holds the Gold, makes the rules!"

And we mean the physical bullion, not some paper substitute. BK

Tuesday, February 8, 2011

Wall Street Journal

By making the announcement, J.P. Morgan is effectively saying gold is as rock solid an investment as triple-A rated Treasurys, adding to a movement that places gold at the top tier of asset classes. It also is trying to capitalize on all the gold now owned by hedge funds and private investors that is sitting idle in warehouses. LINK...

**************************************

Think about what this really means folks? J.P. Morgan one of the most powerful Wall Street Bankers is saying they want your Gold Bullion in exchange for their securities? One has to ask themselves, WHY NOW?

J.P. Morgan is willing to accept a volatile, risky and "Barbarous Relic" as collateral for securities that are as good as AAA rated U.S. Treasury's? Could this mean that the U.S.A. is about to lose their AAA status OR is Gold about to go SKY HIGH? As we said in previous posts,

"He who holds the Gold, makes the rules!"

And we mean the physical bullion, not some paper substitute. BK

"He who holds the Gold, makes the rules"

China adds 5042 tons to their Gold reserve!

From King World News: Interview

****************************************************************

As Jim Rogers has been saying for many years, China will be the next great country of the world. We believe that following China's lead is like investing in America during the 1940's. Sure America had her ups and downs, but she become a great nation at a very young age. Unfortunately it is time to pass the tourch to China. So if Gold is good enough for the next ruling nation of the world then we suggest everyone own some Gold Bullion. BK

From King World News: Interview

****************************************************************

As Jim Rogers has been saying for many years, China will be the next great country of the world. We believe that following China's lead is like investing in America during the 1940's. Sure America had her ups and downs, but she become a great nation at a very young age. Unfortunately it is time to pass the tourch to China. So if Gold is good enough for the next ruling nation of the world then we suggest everyone own some Gold Bullion. BK

Tuesday, February 8, 2011

IMF Central Bankers Agenda: Get Some GOLD!

More and more we see evidence that the banking leaders of the world are considering Gold as a way to fix the financial crisis. Thousands of years of history dictate that Gold is the only honest money and aways emerges as such in times of crisis.

If the Central Bankers around the world are buying Gold, maybe you should too? BK LINK...

If the Central Bankers around the world are buying Gold, maybe you should too? BK LINK...

Friday, February 4, 2011

Thursday, February 3, 2011

Chinese Gold Demand Stuns London & Hong Kong Traders

From: King World News

I think the key here Eric is that inflation is roaring out of control in Asia, particularly in China. While the western monetary authorities are doing their best to convince their citizens that inflation is not a serious problem, the reality is quite different. To quote Bernanke, ‘Fear of inflation is overstated.’ The citizens of Asia and other regions are not impressed with such statements. Those people have been buying gold and they will continue buying gold as long as inflation is alive and well and I see no end to that in the foreseeable future.”

I think the key here Eric is that inflation is roaring out of control in Asia, particularly in China. While the western monetary authorities are doing their best to convince their citizens that inflation is not a serious problem, the reality is quite different. To quote Bernanke, ‘Fear of inflation is overstated.’ The citizens of Asia and other regions are not impressed with such statements. Those people have been buying gold and they will continue buying gold as long as inflation is alive and well and I see no end to that in the foreseeable future.”

Subscribe to:

Comments (Atom)